Act NOW or you won't receive your JobKeeper payments

JOBKEEPER - Take Action Now Or You Won't Get Paid

An Update For Businesses

This is an urgent call to action for JobKeeper eligible businesses. Action is required otherwise you will not receive your JobKeeper reimbursements from the ATO!

Before the ATO releases the JobKeeper cash to businesses, each JobKeeper Eligible Business must complete the ATO ‘Monthly Business Declaration’ on the ATO Portal Online Services Portal.

Payments from the ATO are planned to start in the first week of May, yet this monthly declaration was only launched on the 4th of May 2020, so action needs to be taken ASAP to ensure your cashflow is not impacted. Each month, this declaration must be lodged before the ATO will release the previous months JobKeeper reimbursements. Here are your options on how to proceed:

1. Easy Way - Complete this Monthly

Declaration Form

and Suntax will complete these ‘Monthly Business Declarations’ on your behalf. If needed, an accountant will contact you to work

through any estimates. The cost to prepare these declarations is $165 including GST per month. If you choose this option, you do not need to

read this newsletter any further.

OR

2. Complete the Monthly Declarations yourself using the instructions below.

_____________________________________________________________________________________________________

Follow these steps to complete the ATO ‘Monthly Business Declaration’ yourself

-

Ensure you are registered for the ‘ATO Online Services For Businesses Portal’. If you are not registered for the ATO Business

Portal, please follow these instructions: ATO

Instructions to set up MyGovID & RAM

-

Ensure you have followed the steps from our last Newsletter to ‘Enrol for

JobKeeper’ and have nominated your employees in your STP Payroll system

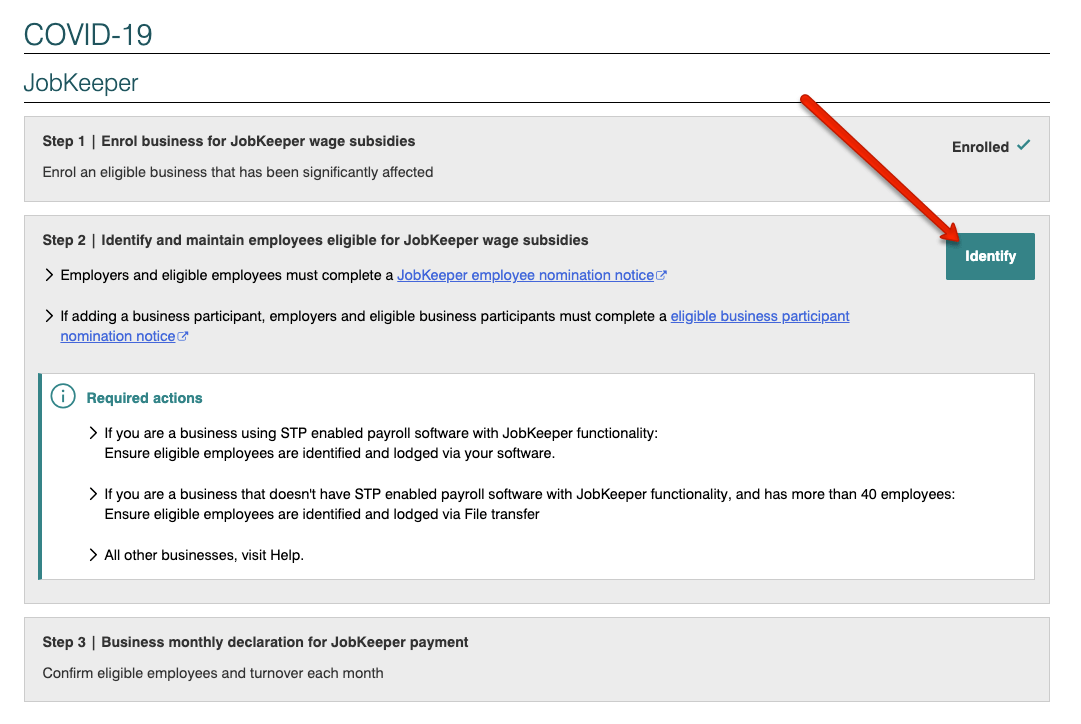

- Once you have confirmed you have enrolled, Log into the ATO Portal

a) Click on 'Manager Employees'

b) Click on 'JobKeeper Enrol'

c) Click the 'Identify' Button at Step 2

4. Complete the Declaration ensuring the following is entered:

a) When selecting 'The month you are applying for JobKeeper wage subsidy' select APRIL if your application is to receive payments from the

first fortnight (stating 30th March 2020)

b) Complete the remaining questions, employee enrolments, confirm your previous months GST turnover and then estimate your current months

GST turnover

5. Tick the declaration box and submit

If these steps are too onerous or time consuming, we have a team at the ready to process your payments. Click Monthly

Declaration Form

to give Suntax the go ahead to sort out the final step so you can receive your JobKeeper Reimbursements.

We have been impressed with the level of creativity, ingenuity and improvisation that our small business clients have shown to keep their businesses running during this pandemic. Hopefully, we’ll be back to normal shortly. In the meantime your Suntax crew are working from home and are here to help you if you need support or guidance.

Regards

Your Suntax Team